Gift Accounts: How they work

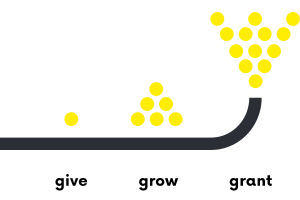

1. Give

You can open a Gift Account simply and easily today and name it whatever you like. Gift Accounts start with a minimum $5,000 donation and you, or anyone else, can donate into your account at any time. Donations are eligible for donation tax credits. There is no need to specify up front what causes you want to donate to, so you can support a variety over time.

2. Grow

For accounts with more than $20,000, your donations can be responsibly and ethically invested in a variety of ways to grow, tax-free.

Read about our Investment Options

3. Grant

You decide when and which charitable causes to support, in New Zealand or internationally. The Gift Trust checks their credentials and can provide research or guidance for your charitable giving. Our donation policy outlines which kinds of causes we can and can’t give to.

Read our donation policy

Read our Guide to Gift Accounts

Together, we’ll make good happen.

Resources to support your donation decisions

Individuals and families brochure